When is the Aussie Employment report and how might it affect AUD/USD?

Australia’s March labour force survey is released today at 01.30GMT and there are expectations for another strong headline print, in line with the Reserve Bank of Australia's upbeat outlook.

Given that weekly payrolls indicate jobs growth held up through recent flooding events in March, Westpac anticipates employment to rise by 25k for the month.

''A lift in participation to 66.5% should see the unemployment rate hold flat at 4.0%. The median forecast is +30k jobs and 3.9% unemployment rate, which would be the first sub-4% rate since 1974.''

How might the data affect AUD?

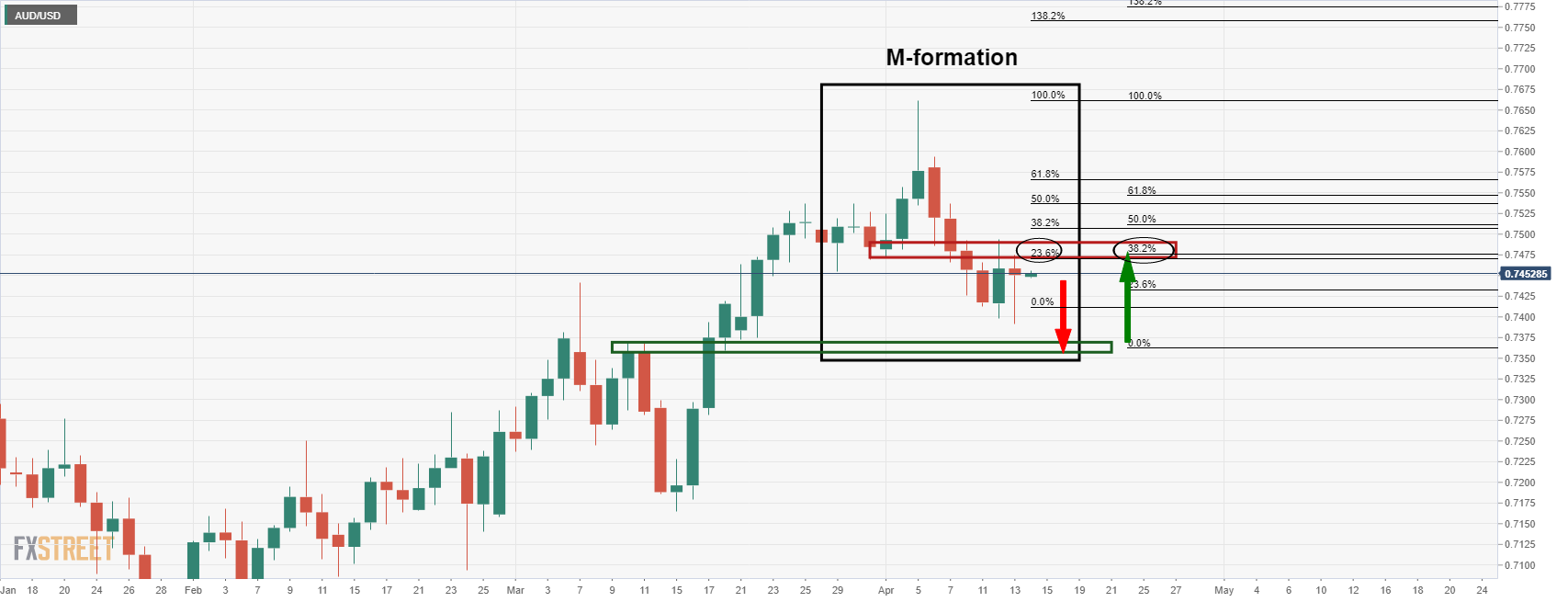

Lower yields have weighed on the US dollar overnight supporting AUD on Wednesday, which finished the day flat. However, strong employment data today could see the Aussie ride higher in this correction. On the other hand, a disappointment would likely send the price on course for a downside extension as illustrated in the following analysis:

-

AUD/USD Price Analysis: More to come from the bears?

''The price is being resisted which could lead to a downside continuation for the days ahead and complete the bearish weekly candle trajectory into the weekly support one around 0.7360. The next catalyst is the Aussie Employment report and if there is a disappointment, AUD would be expected to slide.''

AUD/USD H1 chart

The price will need to get below the 0.7440s on the hourly chart and then 0.7380.

About the Employment Change

This is released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).