Back

22 Dec 2021

GBP/USD Price Analysis: Bulls take on critical resistance, eye 1.34's

- GBP/USD bulls are taking on critical daily resistance.

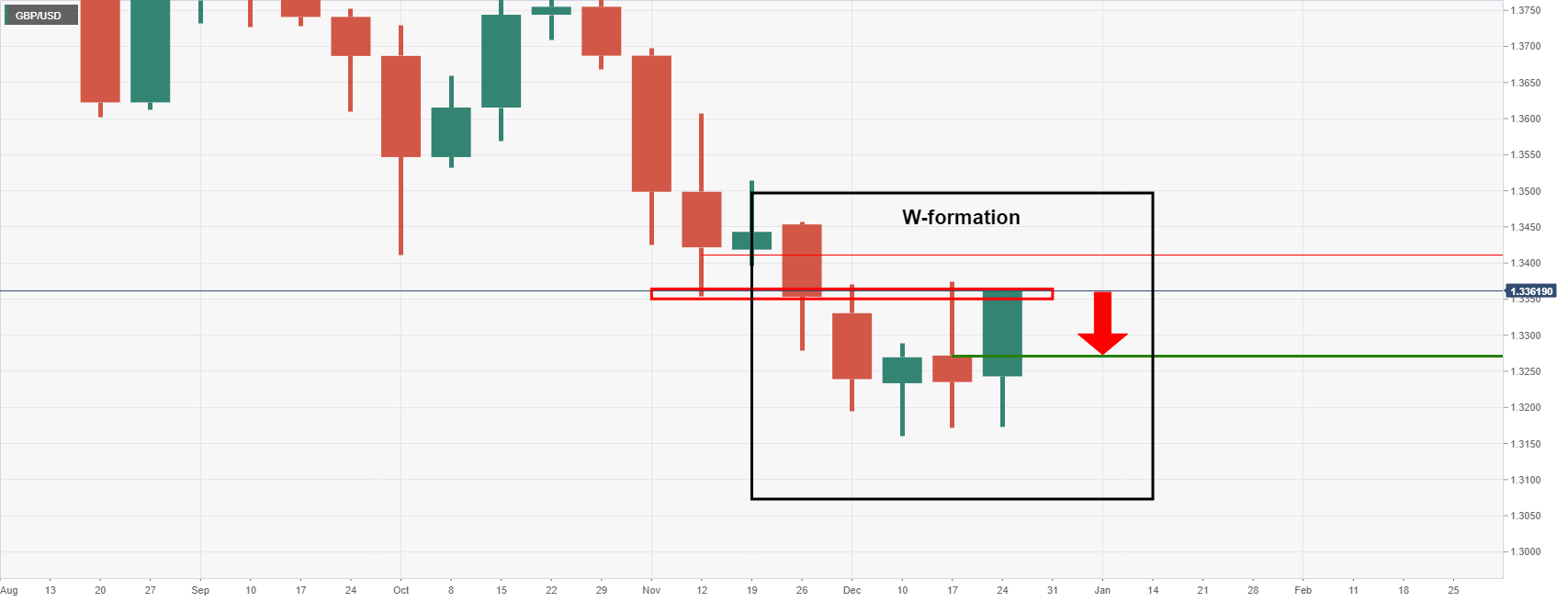

- Bears will be looking for a downside correction, as per the weekly W-formation.

GBP/USD has ended the US sessions firmly bid and has taken out the prior closing highs for the week which leaves the bulls in good stead for the remaining sessions ahead of the holidays. At the time of writing, GBP/USD is higher by some 0.77% after travelling from a low of 1.3239 to a high of 1.3363.

While the 1.34's could be on the cards, the weekly W-formation is noted as a bearish reversion pattern. Therefore, a correction towards 1.3264 as the neckline of the formation could be on the cards for the coming days as illustrated in the following analysis.

GBP/USD daily chart

The price can easily continue for a test into the 1.34 area, however ...

GBP/USD weekly chart

The weekly chart has prospects of a downside correction as follows: