S&P 500 (ES SPY) Technical Forecast: Fed fright causes index implosion

- Equities continue to fall as the fed jumps ahead of the curve.

- Two rate hikes brought forward to 2023 as the S&P and Dow tumble but Nasdaq hangs on.

- S&P future heads for a test of trendline support.

The Fed did what it could not avoid and brought forward its projected interest rate hiking cycle and in the process gave markets the excuse they needed to sell off. Equity markets had been expecting and dare we say hoping the Fed would act on inflation before it was too late and this is what the Fed had to do. Equity markets took it relatively calmly on Thursday but the mood soured on Friday as the Fed's James Bullard talked tough. The market took Bullards testimony badly despite the fact that he is a well-known Fed hawk.

-637598691001508143.png)

S&P 500 (ES SPY) forecast

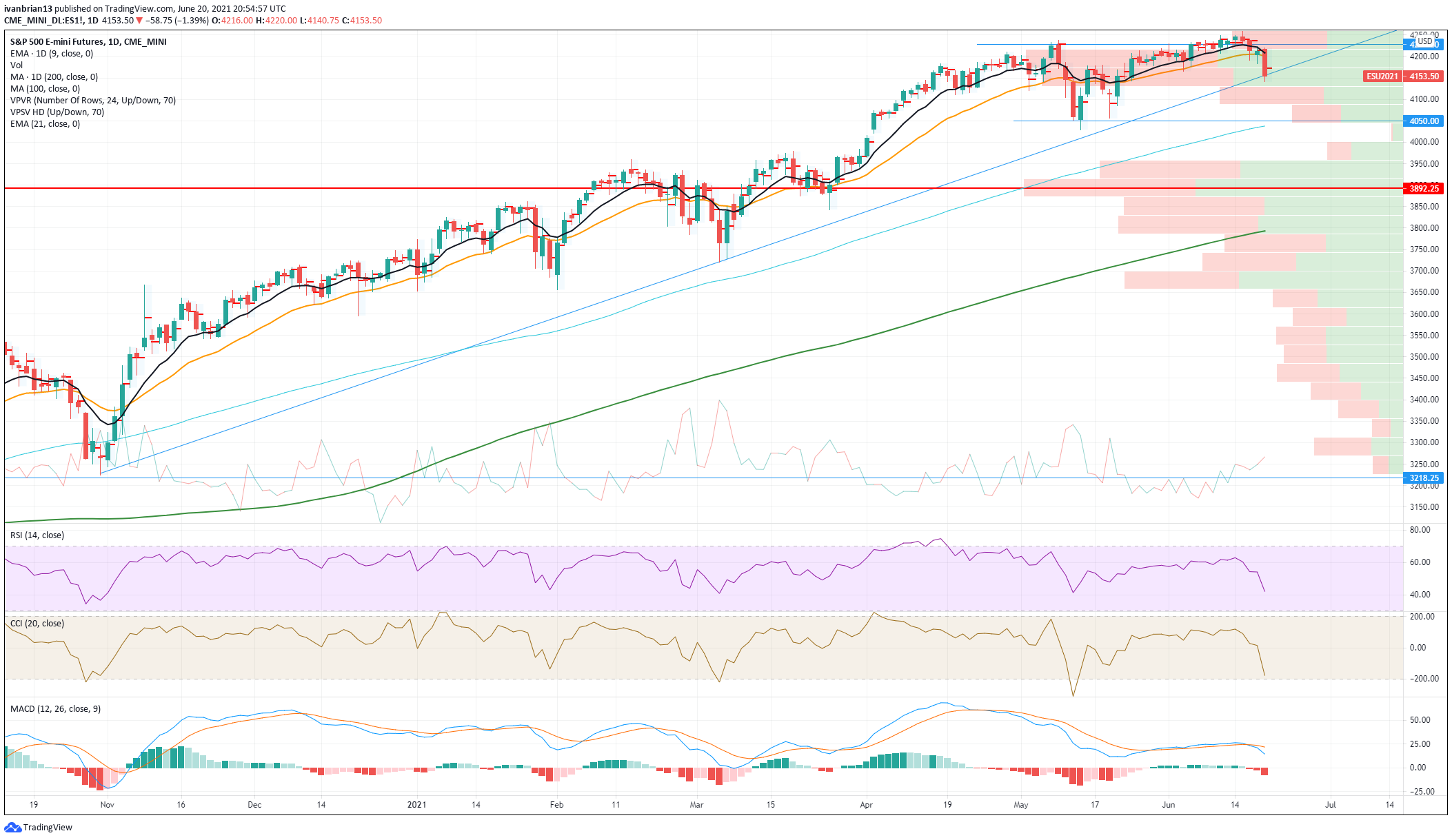

The lead futures contract has retreated to a strong support line at 4155. This is matched in the cash and ETF SPY charts as they track almost exactly. So Monday's session is increasingly important. Is buy the dip still the strategy to be following? Seasonality has been mentioned a lot recently and it cannot be totally discounted. The last two weeks of June are historically tough ones for the equity market so we are not only at a critical price juncture but a critical time juncture also. Fridays' move saw the S&P break the 9-and 21-day moving averages skewing the risk-reward to the downside. The momentum oscillators have trended lower with price in confirmation and the Moving Average Convergence Divergence (MACD has crossed into a bearish signal. The big level is 4050 as volume drops off alarmingly below this as we can see from the volume profile bars on the right of the chart. Any vacuum of volume could and should lead to a price acceleration toward 3950-3900 area.

Overall buy the dip has been working so 4050 is a good entry point if reached, with a tight stop as a break could get ugly. The more bullish could look to the trendline to hold and enter long positions currently but we need the oscillators and short-term averages to be retaken pretty quickly to confirm this strategy.