AUD/JPY Price Analysis: Crosses 84.00 hurdle on RBA minutes, PBOC

- AUD/JPY refreshes weekly top after mixed RBA minutes, PBOC status-quo.

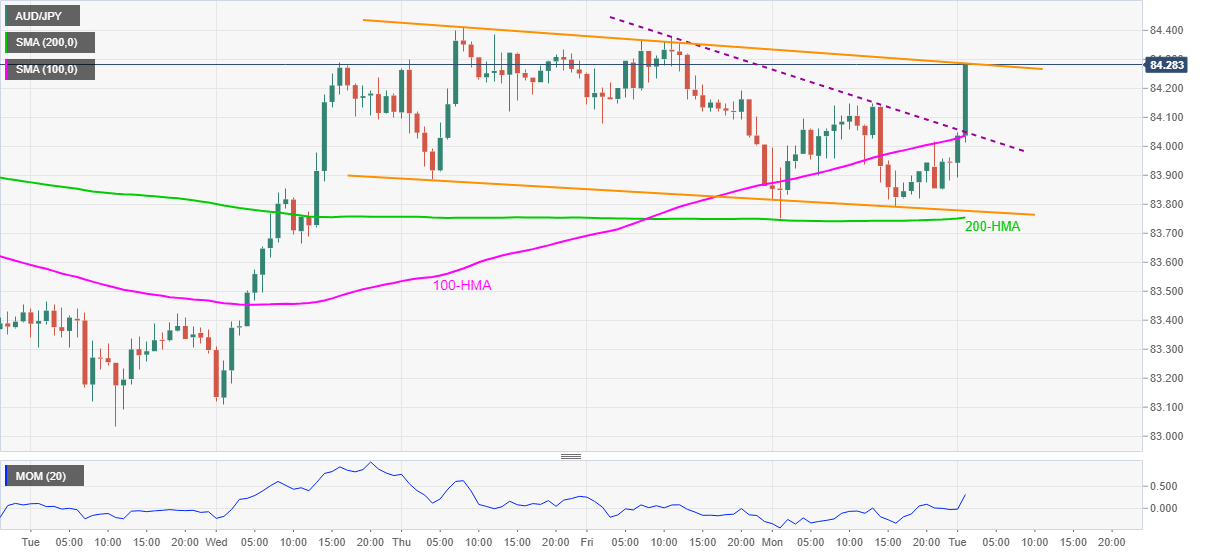

- Short-term falling trend channel can test the bulls.

- Sellers need clear break below 200-HMA for fresh entries.

AUD/JPY stays bid around 84.20, up 0.30% intraday, following the latest uptick to refresh the weekly top during early Tuesday. The pair recently benefited from the Reserve Bank of Australia’s (RBA) monetary policy meeting minutes as well as the People’s Bank of China (PBOC) Interest Rate Decision.

While the RBA policymakers reiterate worries over the unemployment to keep the monetary policy easy, per the minutes, the PBOC offered no change in the benchmark interest rates.

Read: AUD/USD: Mildly bid above 0.7750 despite mixed RBA minutes, PBOC inaction

Even so, the pair crosses a downward sloping trend line from Friday, as well as 100-HMA, following the latest events.

However, the upper line of an immediate descending trend channel, near 84.30, becomes necessary for the pair’s further upside towards the monthly top near 84.50.

In a case where AUD/JPY remains firm beyond 84.50, February’s peak surrounding 84.95 will be the key to watch.

Meanwhile, pullback moves below the 84.00 previous resistance confluence will not be an open welcome for AUD/JPY sellers as the support line of the stated channel and 200-HMA, respectively around 83.80 and 73.75, will be the tough nuts to crack for them.

AUD/JPY hourly chart

Trend: Bullish