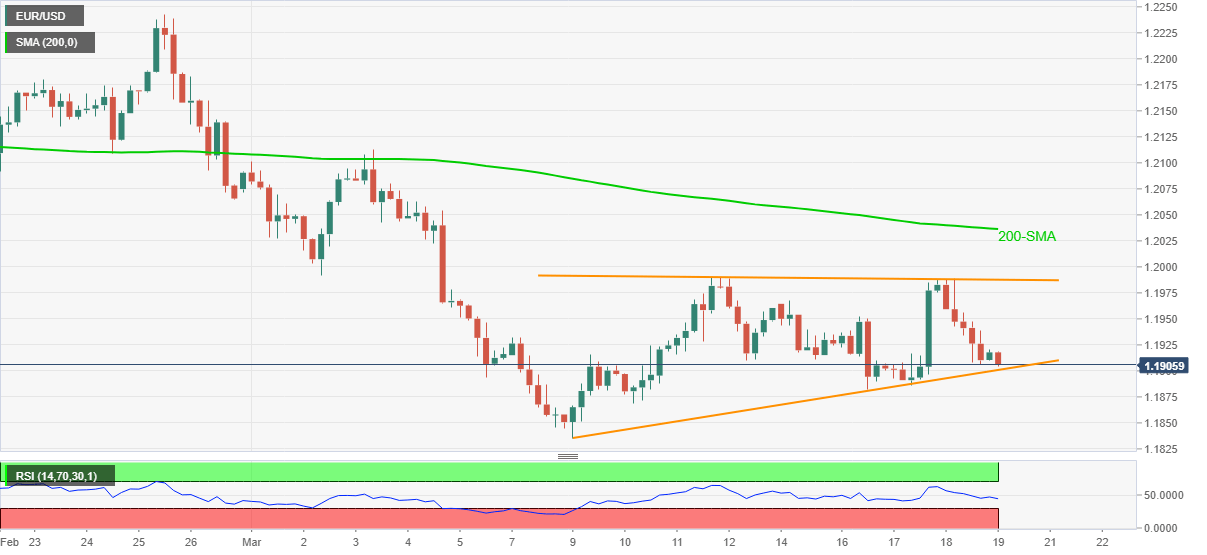

EUR/USD Price Analysis: Bears look for entries below 1.1900

- EUR/USD fades bounce off intraday low while teasing support of a bearish triangle formation.

- Downward sloping RSI like, sustained trading below 200-SMA favor sellers.

- Bulls need to refresh monthly top before retaking the controls.

EUR/USD stays depressed around 1.1900, down 0.07% intraday, amid Friday’s Asian session. In doing so, the quote extends the previous day’s U-turn from the resistance line of an eight-day-old ascending triangle towards attacking the support line of the stated bearish chart pattern.

Considering the downbeat RSI and the pair’s trading below 200-SMA, EUR/USD sellers are likely to break the immediate support, at 1.1900, while targeting the monthly low near 1.1835.

If at all the EUR/USD bears keep the reins past-1.1835, late November 2020 lows around 1.1800 and 1.1745 could return to the charts.

On the flip side, 1.1950 can test the corrective pullback before challenging the triangle’s resistance, currently around 1.1990.

Even if the EUR/USD buyers manage to cross 1.1990, the 1.2000 threshold and 200-SMA level of 1.2036 will challenge the quote’s further upside.

EUR/USD four-hour chart

Trend: Further weakness expected