Back

16 Mar 2021

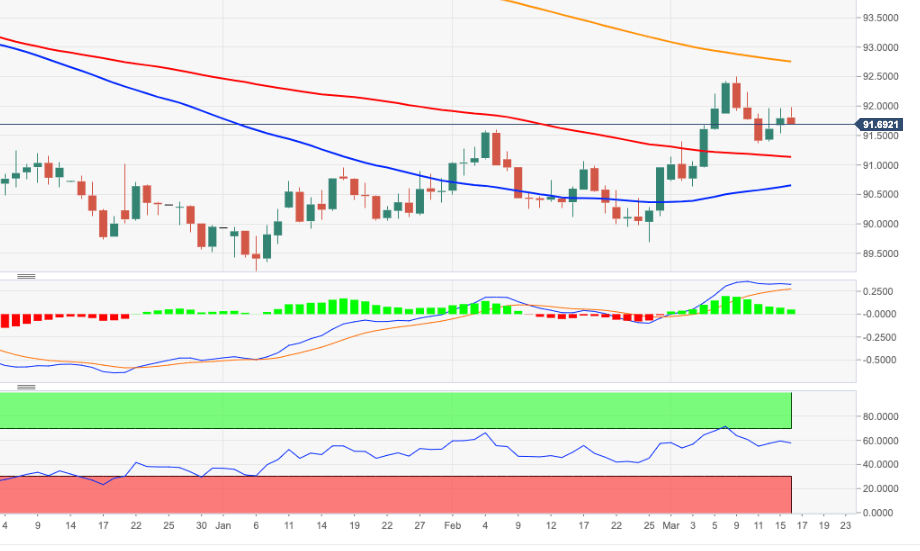

US Dollar Index Price Analysis: Next on the upside emerges 92.50

- DXY faces some selling pressure always below 92.00.

- The next target of note aligns at the YTD peaks around 92.50.

The dollar’s recovery met a tough barrier in the 92.00 neighbourhood so far this week.

If the recovery gathers extra steam, then DXY is expected to re-focus on the so far yearly tops in the mid-92.00s ahead of the critical 200-day SMA, today at 92.75.

A break above the latter should shift the outlook to constructive (from bearish) and allow for further gains.

DXY daily chart