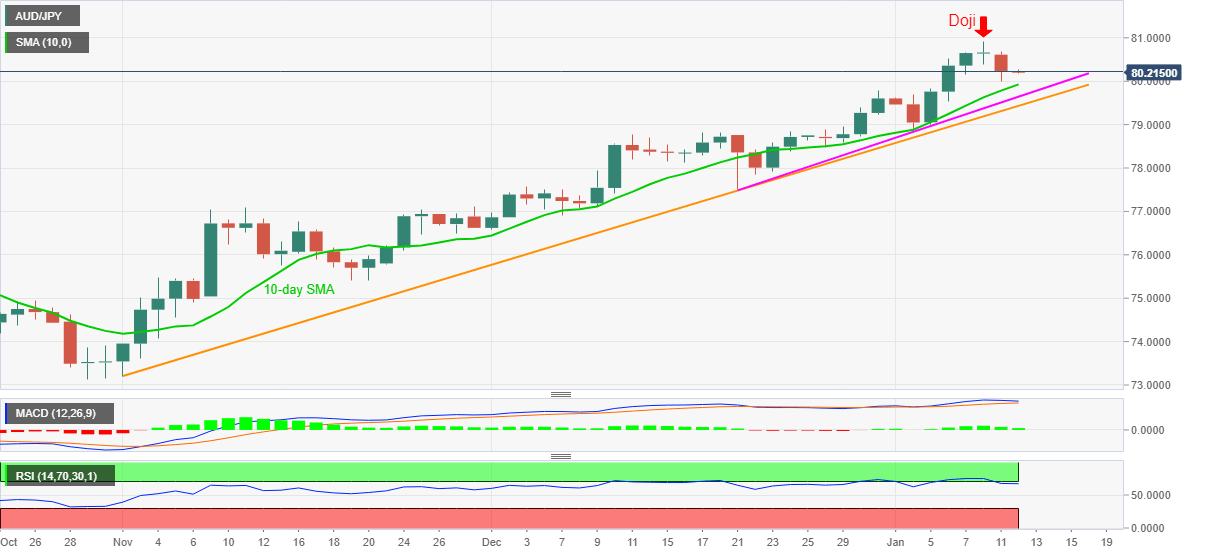

AUD/JPY Price Analysis: Seller’s attack 80.00 to justify Friday’s doji

- AUD/JPY stays defensive while trying to keep recent bounce off 80.00.

- Doji favors pullback but RSI, MACD challenges heavy downside.

- 10-day SMA, key support lines keep buyers hopeful.

AUD/JPY fades corrective pullback from 80.00 while taking rounds to 80.20 during the initial Asian session on Tuesday. The quote dropped the heaviest in over a week the previous day as Friday’s Doji candlestick cheered overbought RSI conditions and receding MACD.

While the 80.00 threshold offered a recent bounce, AUD/JPY prices still have some room to the downside before visiting the technical supports.

Among them, 10-day SMA and an upward sloping trend line from December 21, respectively around 79.90 and 79.65, are likely to challenge the pair’s immediate downside.

It should, however, be noted that any further weakness below 79.65 will be tested by an ascending support line from November’s start, at 79.40 now, a break of which will recall the AUD/JPY bears.

On the contrary, AUD/JPY trading beyond 81.00 will defy the trend reversal suggesting candlestick formation on the daily chart.

Following that, late-2018 levels surrounding 81.20 and the 82.00 round-figure can entertain the sellers.

AUD/JPY daily chart

Trend: Further weakness expected