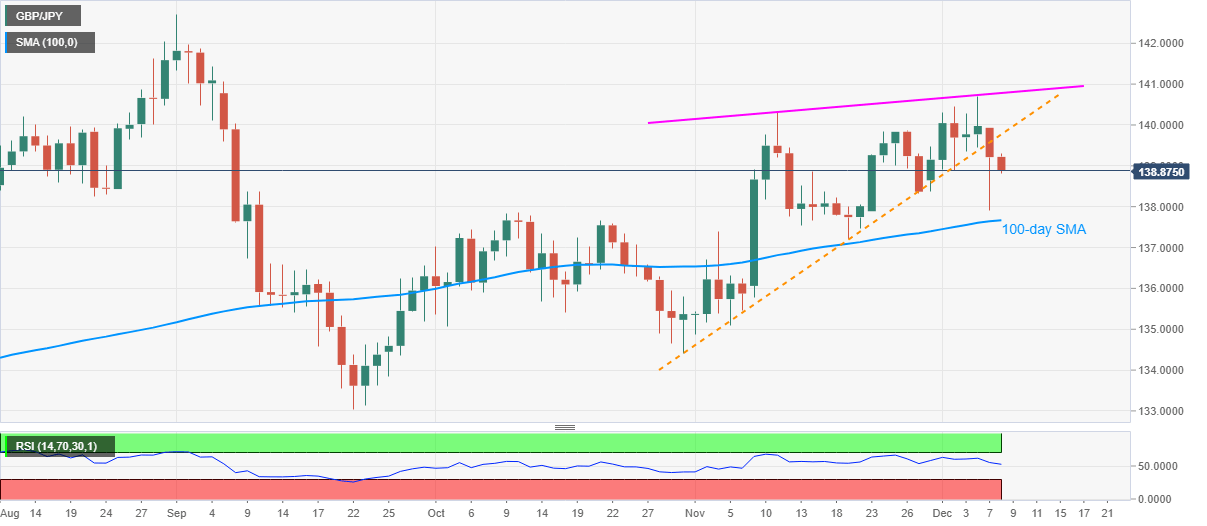

GBP/JPY Price Analysis: Extends break of five-week-old support line below 139.00

- GBP/JPY stays depressed, fails to keep bounce off November 23.

- Receding RSI, sustained downside break of previous support keep sellers hopeful.

- Monthly resistance line offers an extra hurdle to the north.

GBP/JPY drops to 138.84, down 0.26% intraday, during the initial hour of Tokyo open on Tuesday. In doing so, the quote keeps the previous day’s breakdown of an upward sloping trend line from October 30.

Considering the downward sloping RSI conditions and an absence of recovery moves past-trendline break, GBP/JPY sellers are targeting a 100-day SMA level of 137.67 during the further declines.

Though, the November-end low near 138.30, followed by the October top near 137.86, can offer immediate supports to the quote.

Meanwhile, GBP/JPY recovery beyond the previous support line, currently around 139.75, needs to cross the 140.00 round-figure before eyeing a one-month-long rising resistance line, near 140.80.

If at all the GBP/JPY bulls remain dominant past-140.80, the yearly top near 142.70 will be in the spotlight.

GBP/JPY daily chart

Trend: Bearish