AUD/USD bulls need to step up or face an avalanche of supply

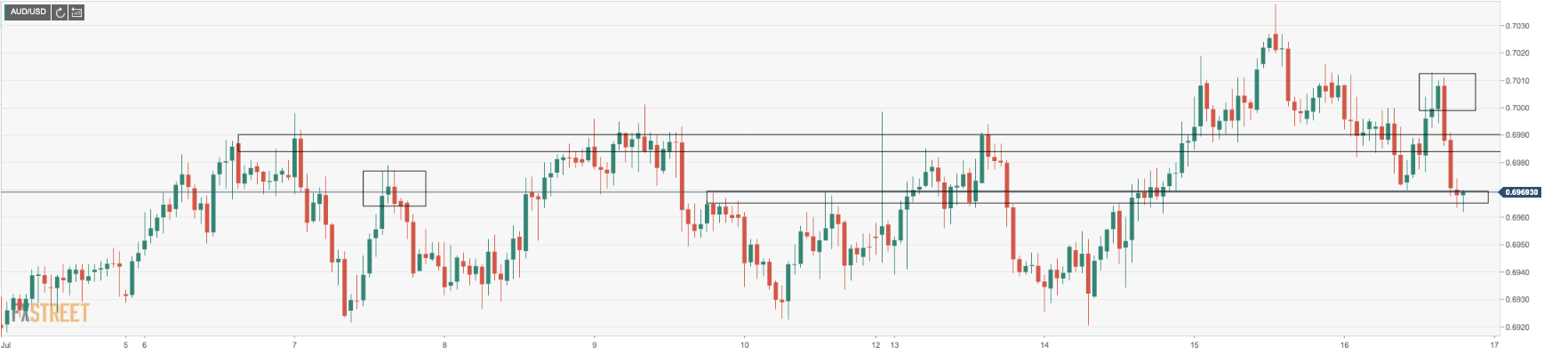

- AUD/USD is failing to convince n the upside, sliding to test critical support.

- If bulls drop the baton at this juncture, it's game over.

AUD/USD is currently trading at 0.6970 between a range of between 0.6968 and 0.7012.

The mood is a touch sour in trade today considering the tensions between the US and China that have been put onto the boil this week following the US President's signing of the Hong Kong expectative order.

On the other foot, we have bulls taking the lead with respect to the hopes for a 2020 COVID-1 vaccine or cure produced by a number of nations in the race.

The promising vaccine headlines, coupled with prospects of a global economic recovery after yesterday's Chinese Gross Domestic data's outcome, should help to stave off too much dominance from the bears.

Meanwhile, domestic data for AUD traders failed to provide too much of a catalyst overnight in the Aussie jobs data. we will now need to wait for the Reserve Bank of Australia's July minutes and Governor Lowe's speech both on Tuesday next week.

We will also have the Federal government economic and budget statement on Thursday the 23rd while the data highlight will be the nation's preliminary June Retail Sales on Wednesday.

Federal government economic and budget statement outlook

Analysts at Westpac note that the local media focus remains on Victoria’scoronavirus resurgence, with record daily cases.

But the emerging cluster of cases in SW Sydney is rattling NSW, already prompting new travel restrictions by QLD and NT.

This sours the economic mood further and places renewed pressure on the federal government to err on the generous side in the 23/7 fiscal update."

This is reinforced by the 7.4% unemployment rate in June, with only 211k of the Apr-May871k jobs losses recaptured."

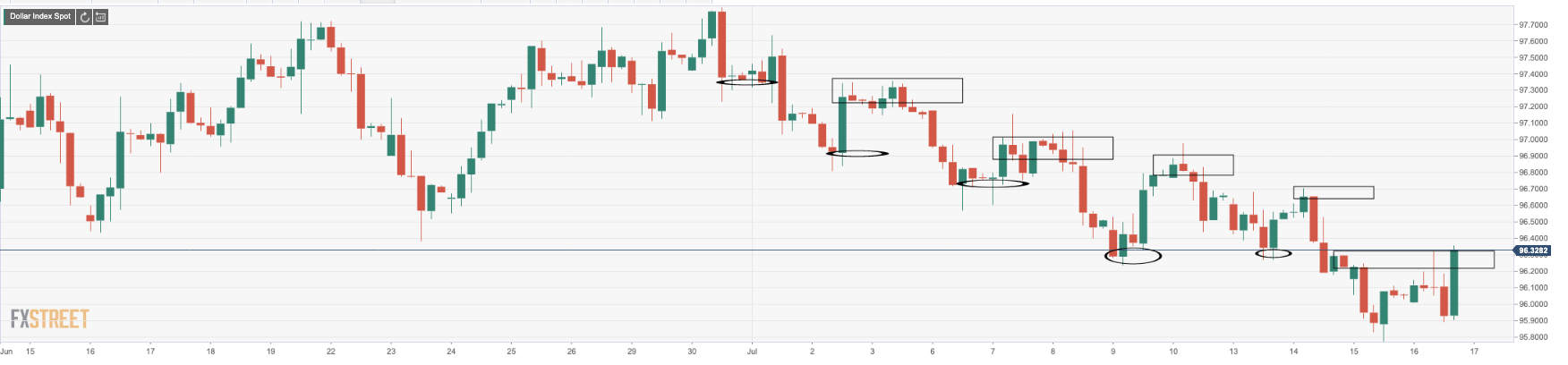

DXY making lower highs

Meanwhile, the USD has struggled to convince on rallies for some time now and there is a soft undertone being reinforced on each failure to the upside.

Today's efforts have done little to mask the underbelly of its "short profile", no matter the risks associated with heightened tensions between the US and China.

CFTC positioning has been supporting bullish AUD/USD spot

Therefore, the positioning data is one to keep in mind. USD net positions have now been in negative territory for four consecutive weeks.

This is pertaining to the strong recovery in risk appetite in recent months.

Conversely, net AUD short positions have continued to shrink.

AUD/USD has already been elevated on the spot market for some weeks, mostly down to its surplus current account balance owing to higher iron ore prices and the recovery in risk appetite lending support.

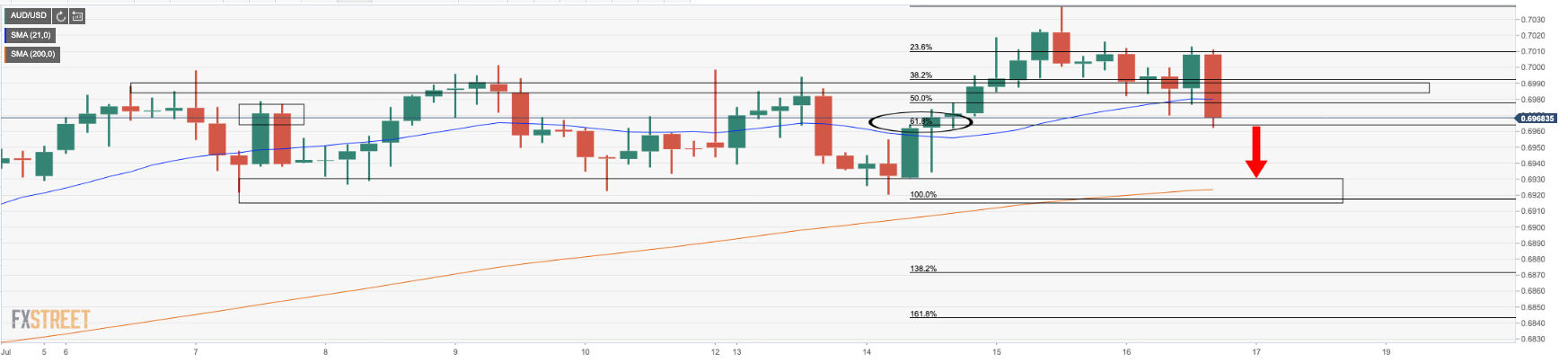

AUD/USD levels

As per the post jobs data piece, the bulls failed to hold above structure and the market has subsequently melted to a critical support area.

Failure to rebound from this 61.8% Fibonacci area opens risk to the next support structure.

4HR time frame