Back

29 Jun 2020

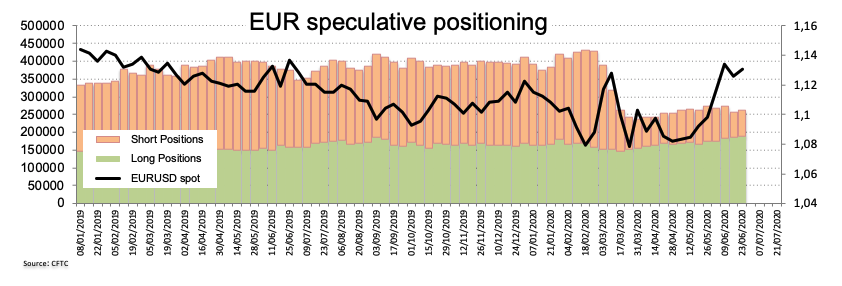

CFTC Positioning Report: EUR net longs kept climbing

These are the main highlights of the latest CFTC Positioning Report for the week ended on June 23rd:

- Speculators added EUR longs for the third week in a row and lifted the net long position to the highest level since May 8 2018 at more than 190K contracts. Hopes of a strong recovery in the bloc following the coronavirus pandemic continued to support the sentiment around the shared currency despite permanent worries over a potential second wave of contagion.

- USD net shorts scaled back to 2-week lows reflecting rising unease and bouts of risk aversion amidst fresh COVID-19 outbreaks around the world. The ongoing massive stimulus package delivered by the Federal Reserve continues to keep a serious upside in the buck somewhat limited.

- AUD net shorts retreated to the lowest level since late April 2018. Indeed, some encouraging results in China coupled with investors’ positive perception of the RBA stance, the government’s handling of the pandemic in Australia and the recovery in commodity prices have been lending support to the currency in the past couple of weeks.