Back

3 Apr 2020

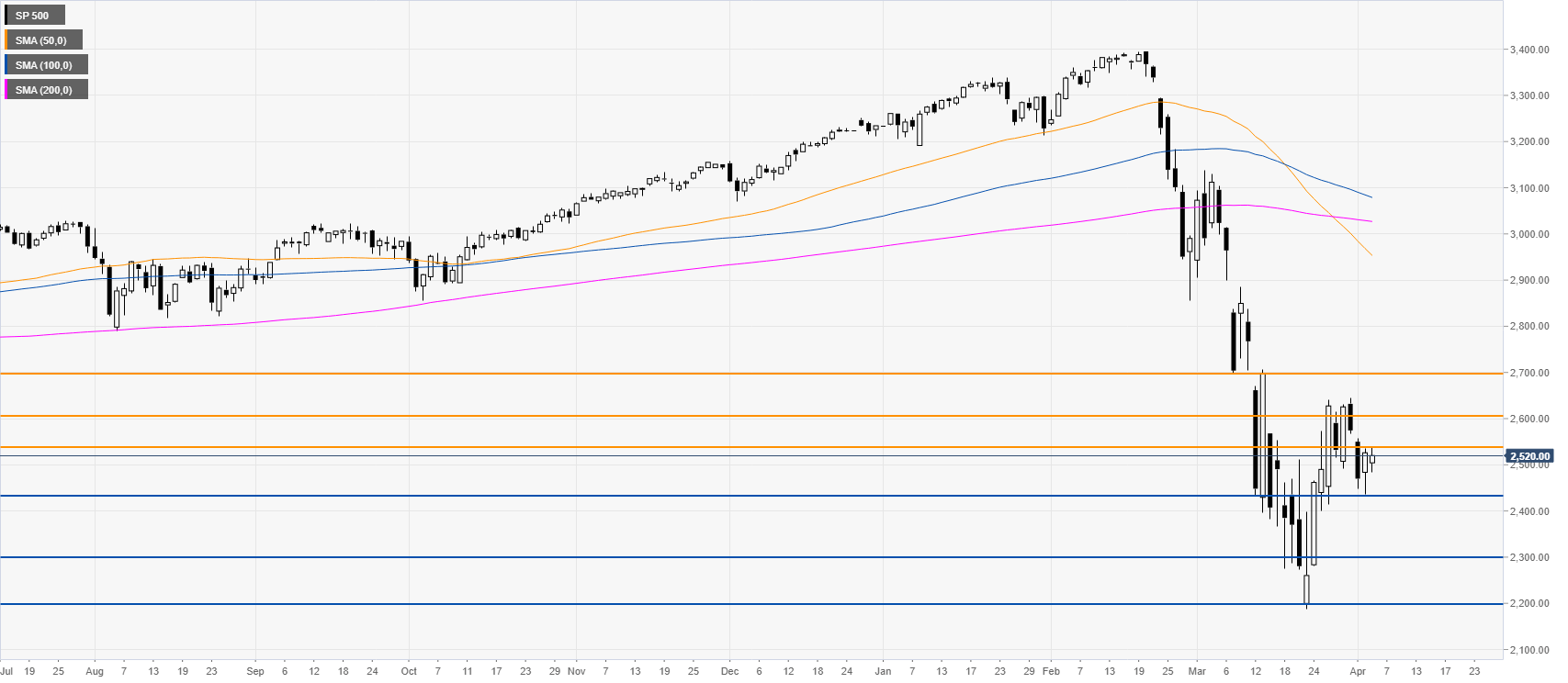

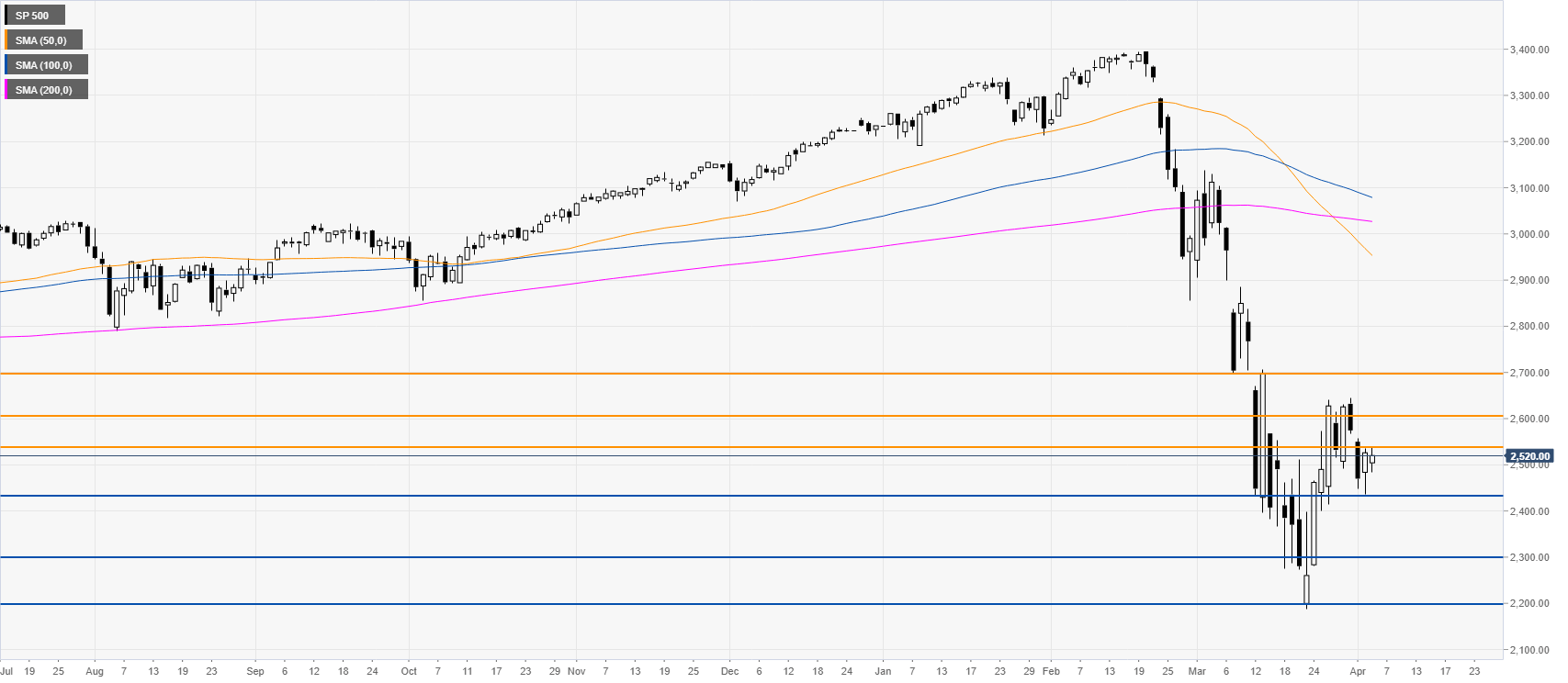

S&P 500 Price Analysis: Dead-cat bounce could see US stocks fall to 2300 level

- S&P 500 remains vulnerable below the 2540/2600 resistance zone.

- US Nonfarm Payrolls plummeted by 701K in March.

S&P 500 daily chart

The S&P 500 remains vulnerable below the 2540/2600 resistance zone as the US Nonfarm Payrolls plummeted by 701K in March. The bullish reaction at the end of March might be a dead-cat bounce as sellers could come back en masse to the market to drive it to the 2300 and 2200 levels on the way down while resistance should be expected near the 2540, 2600 and 2700 levels.

Additional key levels