Back

4 Mar 2020

EUR/USD Price Analysis: Bears lurking, lower highs, lower lows, 1.0997 eyed

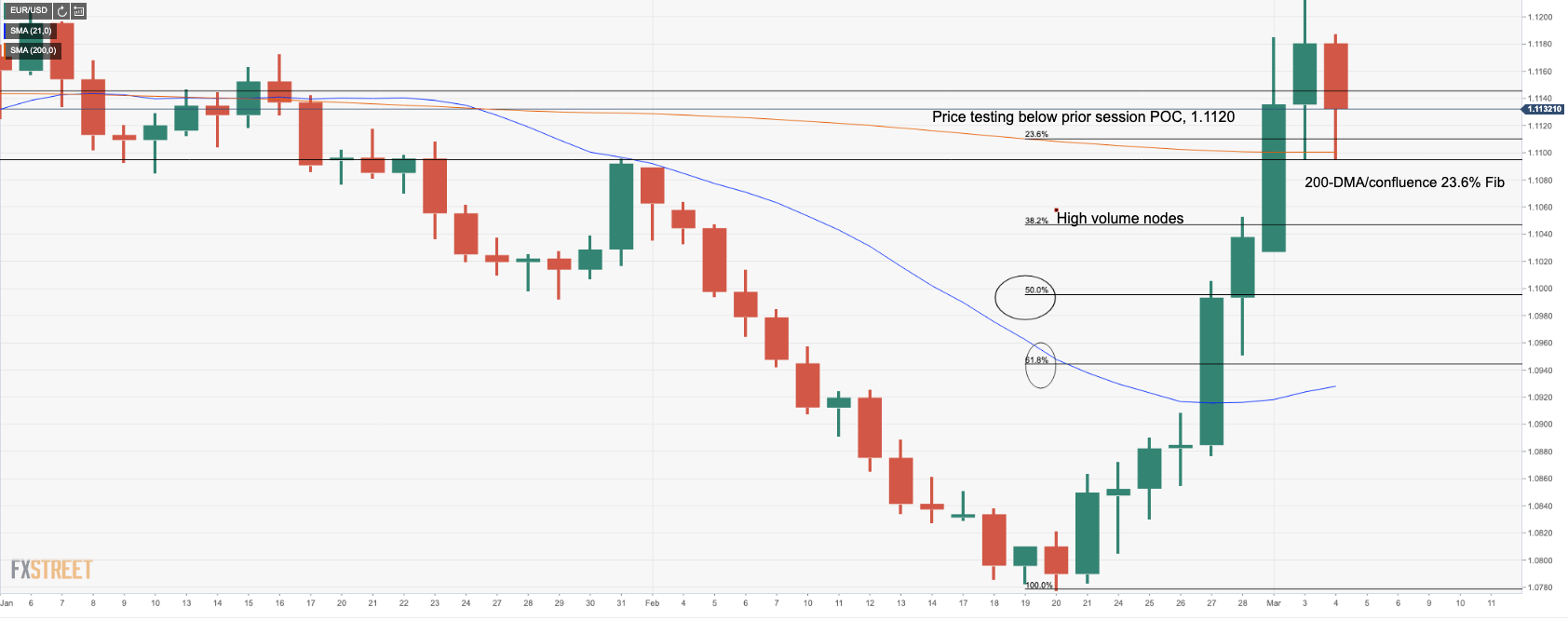

- EUR/USD has started to form a rounding top, completing a 23.6% Fibonacci retracement into higher volume nodes.

- A break of 1.1093 opens risk 1.1049 for a 38.2% Fibonacci retracement ahead of 1.0997 mean reversion target.

- The golden ratio retracement target, 61.8% Fibonacci, is located at 1.0945.

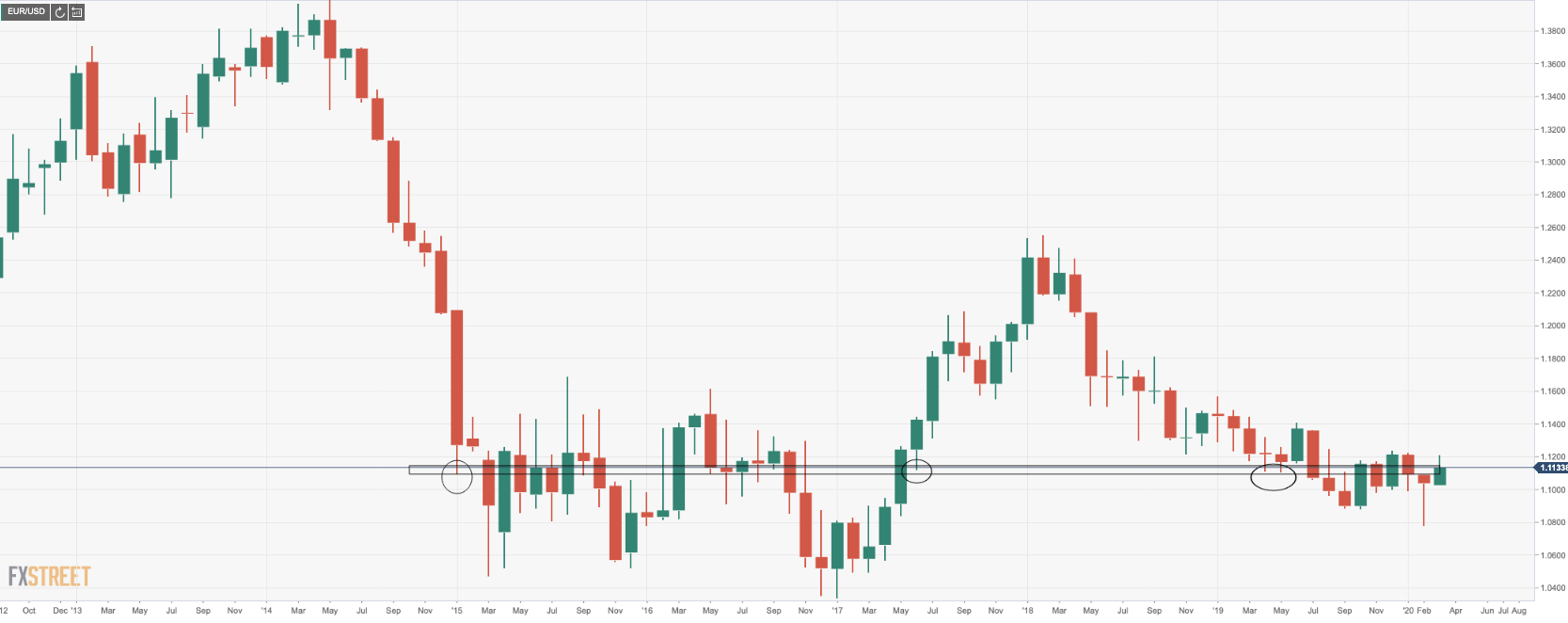

The bulls have been charging in recent sessions due to an exodus from emerging market currencies, (EM-FX), fuelling a buyback in the euro, borrowed to for its lower borrowing costs to fund higher-yielding investments. However, in recent sessions, we have started to see a build-up of selling volume and a rounding-top in EUR/USD with the price pressured in a series of lower highs and lows back to a 23.6% Fibonacci retracement of the move up. As can be seen, the price is resting at a monthly level. Should this give way, from a volume profile analysis, we can see that the higher volume nodes in recent sessions have been already tested until a 38.2% that guards a 50% and then a 61.8% Fib target.

EUR/USD resting at key monthly levels

EUR/USD market profile studies point to 61.8% Fib target