NZD/JPY Price Analysis: Probes 18-day-old trendline resistance on RBNZ’s Orr

- NZD/JPY holds onto recovery gains from the key support area as RBNZ Governor speaks.

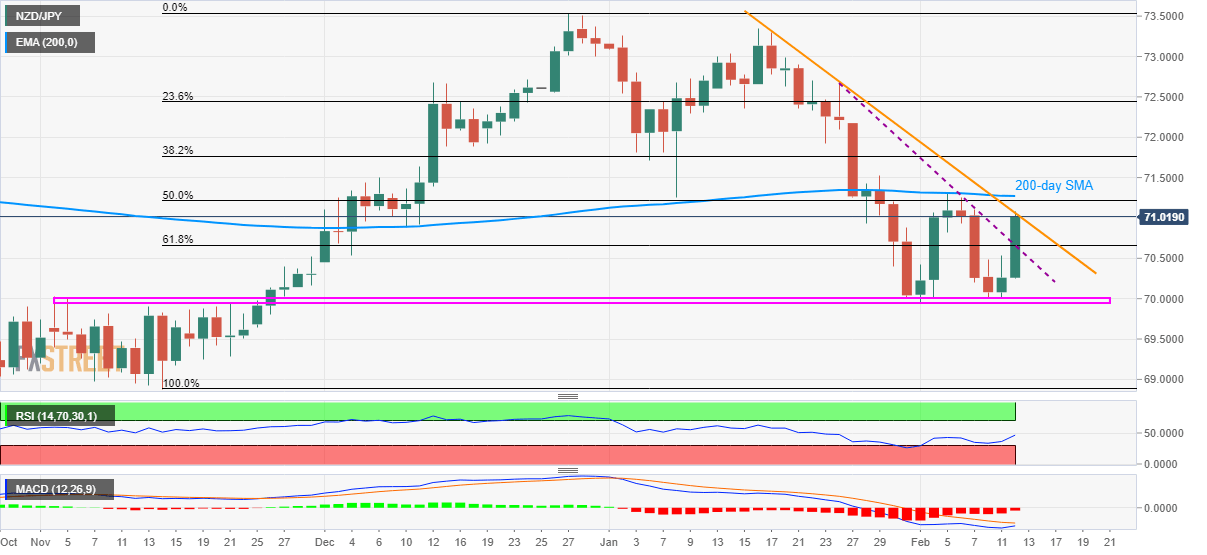

- 14-week-old horizontal support becomes the key to watch below 61.8% Fibonacci retracement.

- 50% Fibonacci retracement, 200-day EMA stand tall to challenge the buyers.

NZD/JPY takes the bids to 71.0450 after the RBNZ Governor Adrian Orr refrained from spoiling the upbeat mood following the central bank’s interest rate decision off-late.

The central banker expected the coronavirus risks to last for six weeks while also anticipating fiscal policy measures to help going forward.

Read: RBNZ’s Orr: Confident around fiscal spending will shift burden of monetary policy

The pair earlier justified the RBNZ’s hawkish halt of the official cash rate by crossing a downward sloping trend line since January 24.

Read: Breaking: A 'hawkish' RBNZ leaves OCR on hold at 1.0% (NZD jumps to 0.6442 resistance)

A confluence of 50% Fibonacci retracement of the pair’s November-December 2019 upside and 200-day EMA, around 71.20/30, becomes the tough nut to crack for buyers.

Should there be a sustained break of 71.30, the early-January lows near 71.70 and 72.00 will be on the bulls’ radars.

Meanwhile, 61.8% Fibonacci retracement level of 70.63 can act as immediate support ahead of the horizontal area near 70.05-69.95 comprising early-November tops and the monthly lows.

In a case where the bears dominate below 69.95, November 14 bottom close to 68.90 could return to the charts.

NZD/JPY daily chart

Trend: Further recovery expected

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com