GBP/USD technical analysis: Plummets to near 2-week lows, challenges 1.2800 support area

- Intraday uptick faced rejection near 1.2880 confluence resistance.

- Two BoE MPC members voted for a rate cut and weighed further.

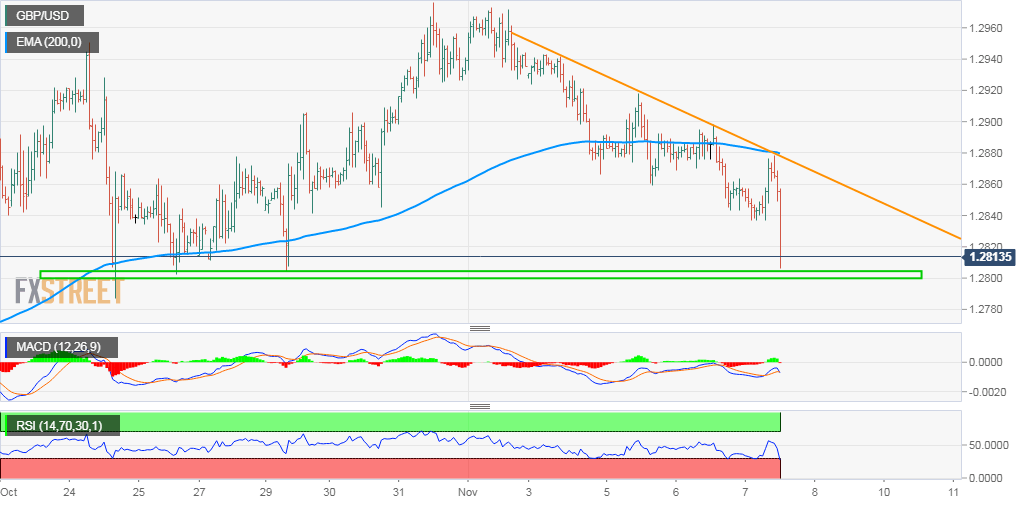

The GBP/USD pair failed to capitalize on its attempted intraday positive move and started retreating from the 1.2880 confluence resistance – comprising of 200-hour EMA and a short-term descending trend-line. The rejection slide accelerated further after two BoE MPC members unexpectedly voted for an interest rate cut.

The pair dropped to fresh 1-1/2 week lows immediately after the announcement and is currently placed near the lower band of its recent trading range, just above the 1.2800 handle. Weakness below the mentioned support might be seen as a key trigger for bearish traders and pave the way for a further near-term depreciating move.

Meanwhile, technical indicators on the hourly charts have been drifting lower in the bearish territory but are already flashing slightly oversold conditions. Moreover, oscillators on the daily chart – though have eased from the recent highs – maintained their bullish bias and thus, warrant some caution before placing any aggressive bearish bets.

Having said that, a sustained break below the 1.2800-1.2790 region might still turn the pair vulnerable to continue with its downward trajectory and aim towards testing the 1.2700 round-figure mark. An intermediate support is pegged near mid-1.2700s, though is unlikely to provide any immediate respite to the GBP bulls.

On the flip side, any attempted recovery now seems to confront some fresh supply near the 1.2845-50 region, above which the pair is likely to make a fresh attempt toward clearing the 1.2880 confluence barrier. The momentum could further get extended beyond the 1.2900 handle towards the next major hurdle near the 1.2935-40 region.

GBP/USD 1-hourly chart