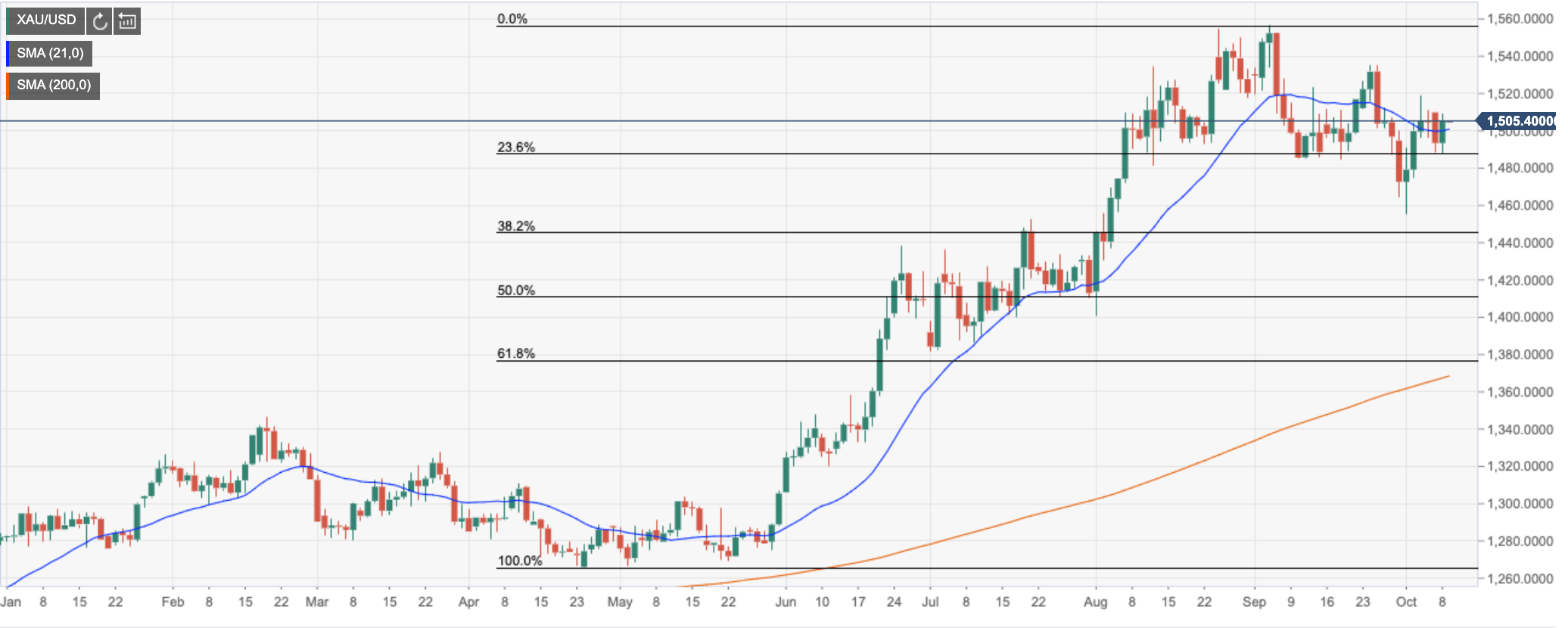

Gold technical analysis: Bulls committed to protecting $1500 the figure

- The 21-day moving average has been crossed but the bulls need a close above 1520.

- Persistent failures below 1520, and for that matter, 1535, will open up prospects for a bearish run again.

Bulls buffed up their bids overnight and stepped in below 1500 the figure as the pair slid on broad US dollar strength. 1487 was the lows until the price got back over the line, albeit still a stretch from the gain line as being the 3rd October highs of 1519.

At this juncture, the 21-day moving average has been crossed but the bulls need a close above 1520 to open prospects for the 1535 resistance. Persistent failures below 1520, and for that matter, 1535, will open up prospects for a bearish run again. Bears can target a break to below a 50% mean reversion of the late June swing lows to recent highs around 1460/70. On the wide, the 200-DMA is located at 1380 meeting a 61.8% retracement of the April lows to Aug/Sep double top highs - a key target for the bulls, located in the 1550s.

Gold daily chart