EUR/USD finds support near 1.1400 on mixed data

- The decline in spot met contention near the 1.1400 handle.

- The greenback faces strong resistance in the 96.00 area.

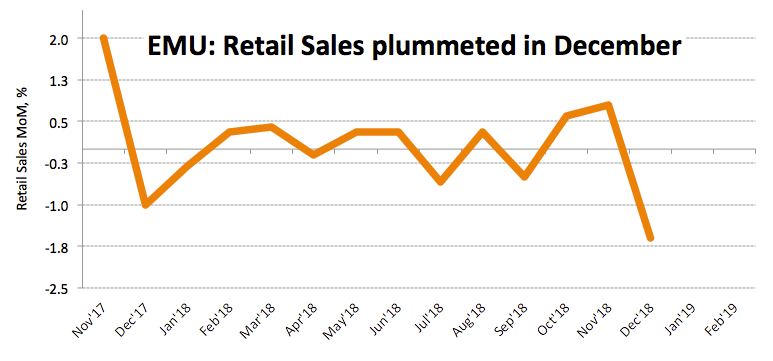

- EMU Retail Sales contracted 1.6% MoM in December.

After bottoming out in the vicinity of the 1.1400 mark, EUR/USD is now attempting to rebound following the mixed results from the EMU docket.

EUR/USD bounces off lows post-data

Spot has managed to stage a mild rebound after Services PMI in the euro bloc unexpectedly rose to 51.2 during the first month of the year (from 50.8). However, on the soft note, Retail Sales in the region contracted at a monthly 1.6% during December.

In the meantime, the persistent buying interest around the greenback continues to keep spot under pressure despite the prevailing mild risk-on sentiment in the global markets on speculations of further progress in the US-China trade talks.

Later in the day, the US ISM Non-manufacturing will grab all the attention seconded by the IBD/TIPP index and the API weekly report.

What to look for around EUR/USD

The extent and duration of the slowdown in Euroland continues to be in centre stage following recent figures from Q4 GDP, while higher-than-expected advanced CPI figures in January appear to have sparked some optimism among investors. On the political side, the upcoming EU parliamentary elections (May) should start to gather extra interest, always with a close eye on the potential advance of populist views among members.

EUR/USD levels to watch

At the moment, the pair is losing 0.15% at 1.1419 and a break below 1.1411 (low Feb.5) would target 1.1406 (low Jan.30) en route to 1.1392 (55-day SMA). On the other hand, the next hurdle emerges at 1.1514 (high Jan.31) seconded by 1.1515 (50% Fibo of the September-November drop) and finally 1.1569 (2019 high Jan.9).