Back

11 Sep 2018

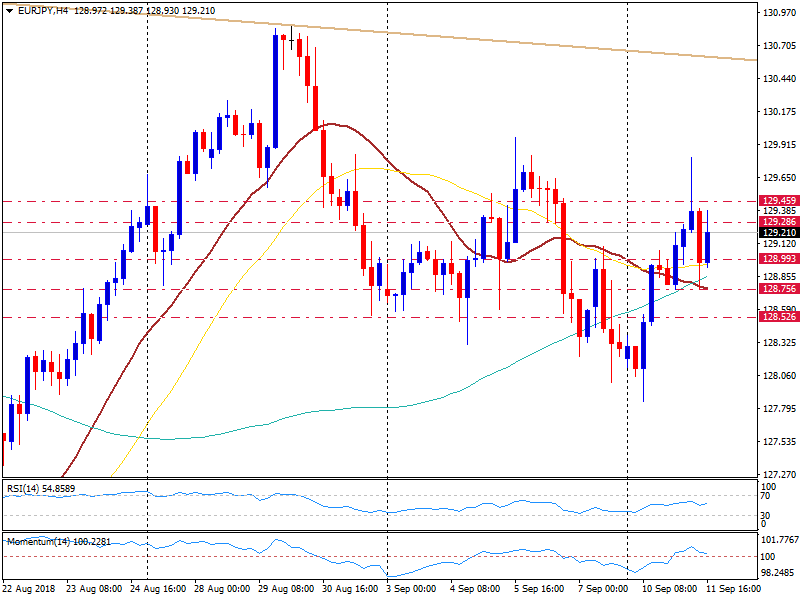

EUR/JPY Technical Analysis: Short-term bias still bullish but momentum eases

- The euro is rising for the second day in a row against the yen but retreated significantly from the top, signaling difficulties to the upside.

- The move higher lost strength slightly below 130.00 and a consolidation on top would clear the way to more gains. Before that level, it needs to break and hold above 129.75.

- The current short-term bias is not clear, the key support is seen around 128.75 (20-SMA in 4 hour chart) and then at 128.50 (also the 20-day moving average). A daily close under 128.50 would increase the odds of a test of 128.00 and of September lows at 127.84.

EUR/JPY 4 hour chart

Spot rate: 129.23

High: 129.80

Low: 128.75

Trend: Sideways

Resistance 1: 129.45

Resistance 2: 129.75

Resistance 3: 130.00

Support 1: 128.75 (Sep 11 low)

Support 2: 128.30 (Sep 4 low)

Support 3: 128.00