GBP/USD 'shot down' near 1.2520; decent US data saved dollar bulls

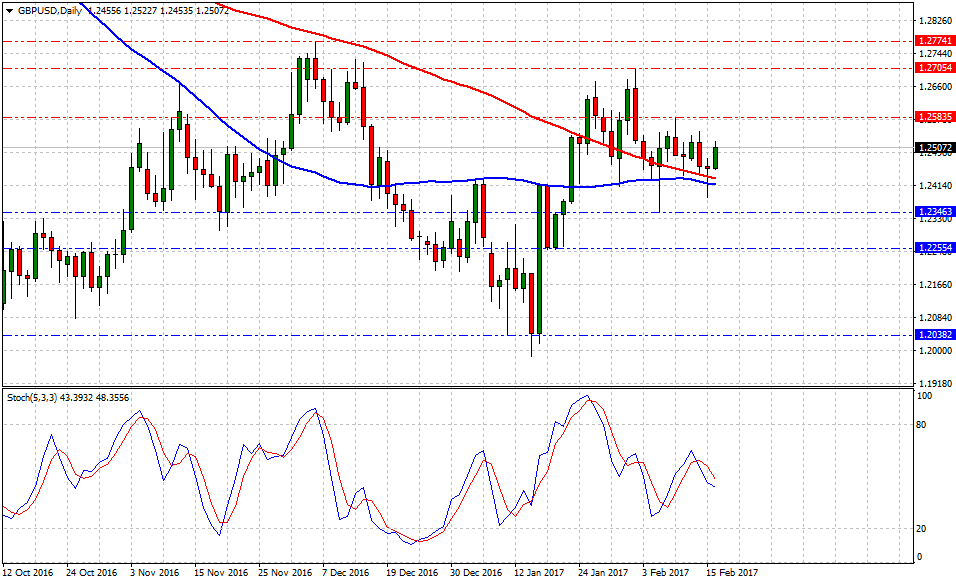

Currently, GBP/USD is trading at 1.2498, up +0.35% or (43)-pips on the day, having posted a daily high at 1.2522 and low at 1.2454.

On the US economic docket, the saga continued as Initial Jobless Claims clocked 239K 'a better than expected' figure against 245K consensus and slightly similar to 234K previous. Furthermore, Building Permits Change made an interesting statement at 4.6% from previously revised figure 1.3%.

The British pound vs. American dollar has been 'in the middle of nowhere' for 2-consecutive weeks as the bearish pressure keeps the pair moving sideways limited around 230-pips from low to high.

GBP/USD poised to extend the sideline theme – UOB

Historical data available for traders and investors indicates during the last 7-weeks that GBP/USD pair, also known as the Cable, had the best trading day at +3.01% (Jan.17) or 373-pips, and the worst at -1.19% (Jan.18) or 146-pips.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 1.2581 (high Feb.9), then at 1.2705 (high Feb.2) and above that at 1.2777 (high Dec.6). While supports are aligned at 1.2345 (low Feb.7), later at 1.2260 (low Jan.20) and finally below that at 1.2010 (Jan.17). On the other hand, Stochastic Oscillator (5,3,3) seems to retrace from the oversold territory, therefore, there is evidence to expect further dollar gains in the near term.

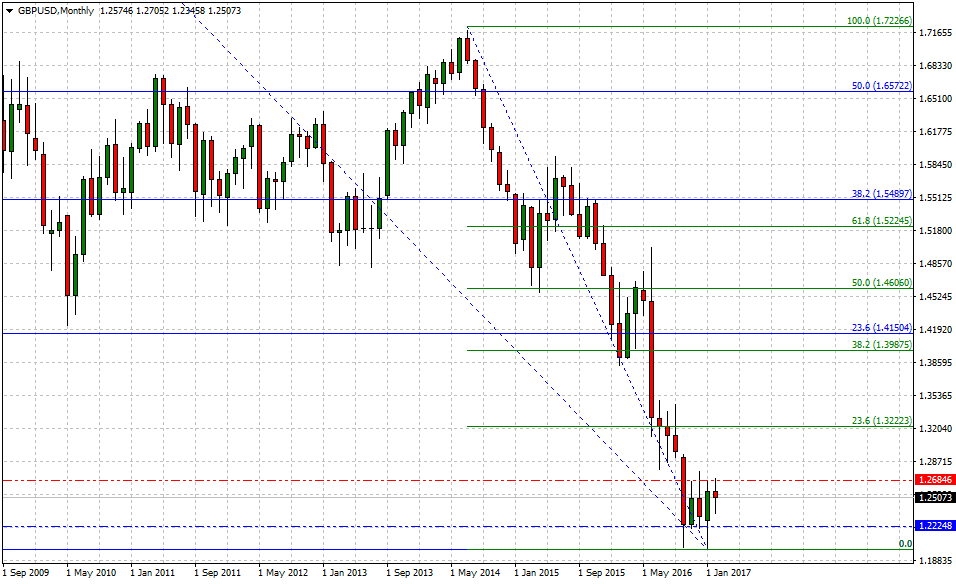

On the long term view, if 1.1985 (low Jan.16) is in fact, a short-term bottom, the upside runs all the way towards 1.3210 (short-term 23.6% Fib). However, without removing the 'hard' dark cloud from all Brexit negotiations, the sterling faces a gargantuan resistance level against 1.3978 (short-term 38.2% Fib) and 1.4153 (long-term 23.6% Fib).

GBP/USD Forecast: nearing key 1.2540 region