USD/CAD bounces off lows, retakes 1.3050

After dropping to the 1.3030 in early trade, USD/CAD has now retaken the mid-1.3000s ahead of the US open.

USD/CAD attention to US docket

The pair remains in the area of weekly lows just above the psychological 1.3000 handle so far today, always against the backdrop of a broad-based correction lower in the greenback after the recent Yellen-led rally.

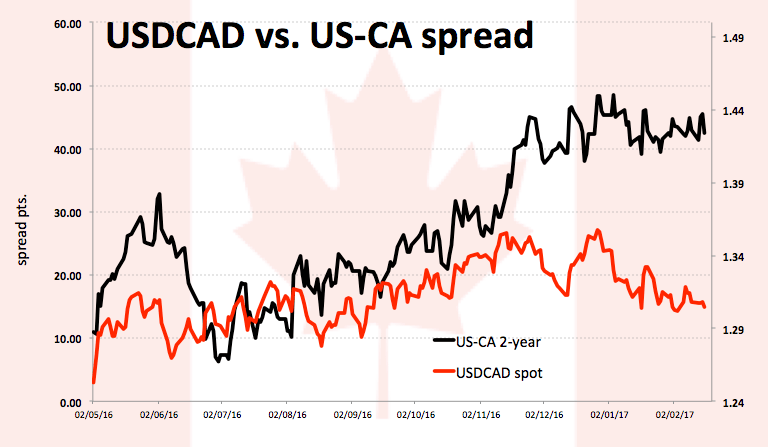

Spot keeps the choppy trade for the time being, struggling for direction while neither US-CA yield spreads nor crude oil dynamics emerge as a definitive catalyst for the price action. The barrel of West Texas Intermediate is extending its sideline theme around the $53.00 mark despite the recent large builds in US crude supplies as reported by the API (Tuesday) and EIA (Wednesday).

Next on tap, US Housing Starts, Building Permits and the Philly Fed manufacturing index should keep the attention on the buck.

USD/CAD significant levels

As of writing the pair is losing 0.30% at 1.3041 facing the next support at 1.3022 (low Feb.14) seconded by 1.3016 (low Jan.17) and then 1.2967 (low Jan.31). On the other hand, a surpass of 1.3109 (20-day sma) would aim for 1.3121 (high Feb.15) and finally 1.3144 (200-day sma).