Back

16 Jun 2023

AUD/USD Price Analysis: Bulls run into daily resistance, eyes on key supports

- AUD/USD bears are in the market and eye the 38.2% Fibo.

- Daily trendline supports are a focus on the downside.

The Australian dollar has been running on its last gas into the close on Friday with the price at its highest in four months, after surging 1.3% overnight. It is set for a 2.2% weekly gain, the best since mid-November 2022, and way off its 2023 low of $0.6459 two weeks ago. Technically the price is now reaching a daily order block:

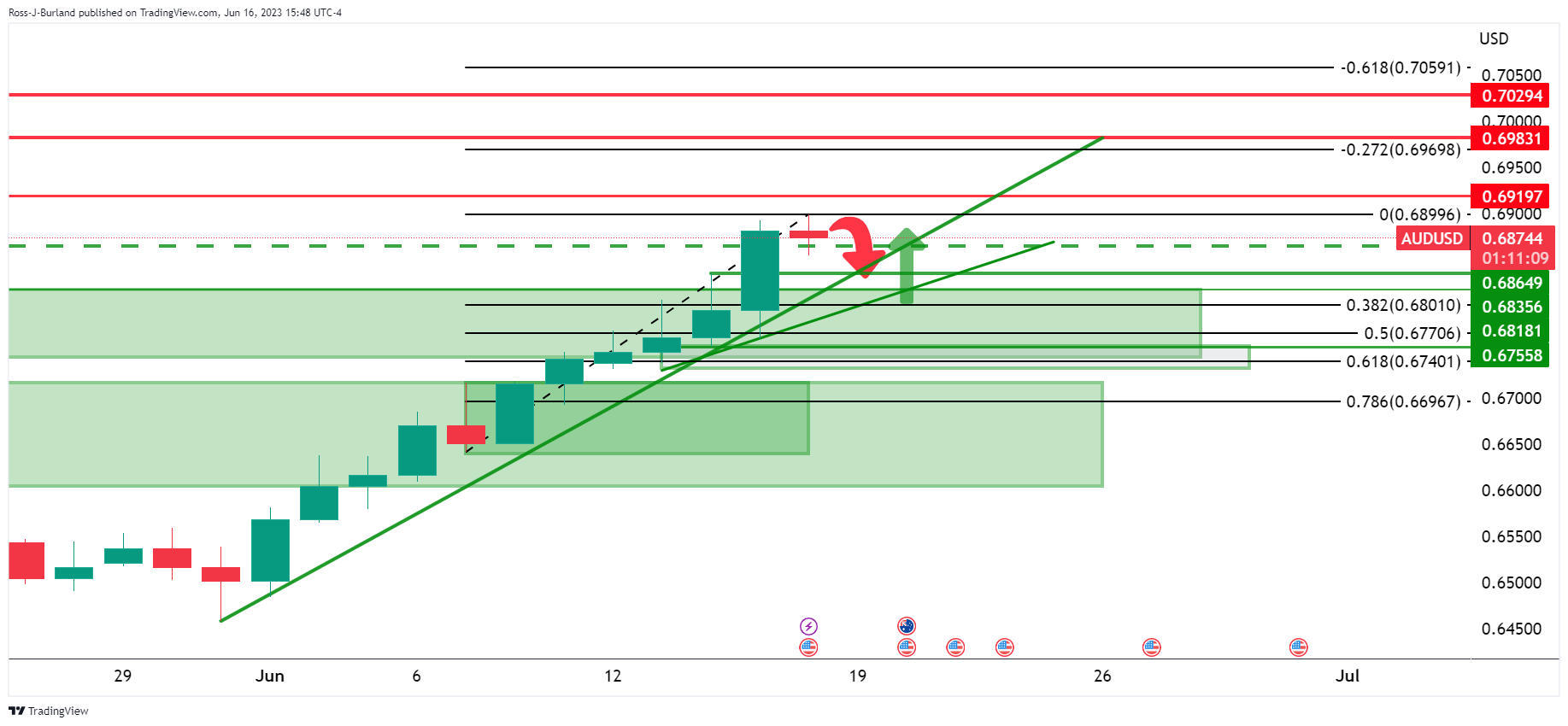

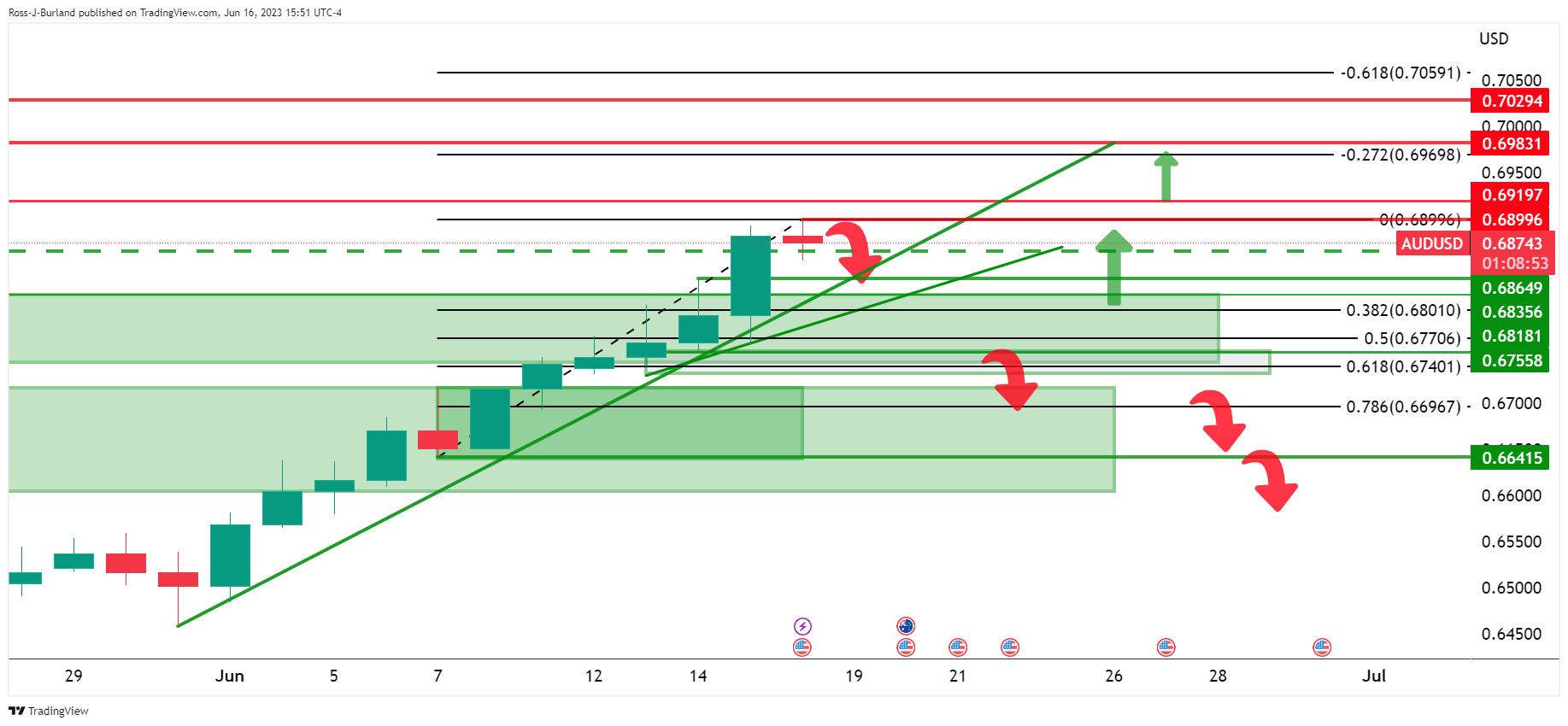

AUD/USD daily charts

At this juncture, there could be a sell-off and to target the depths of the 0.68s:

We have trendline supports to target as well.

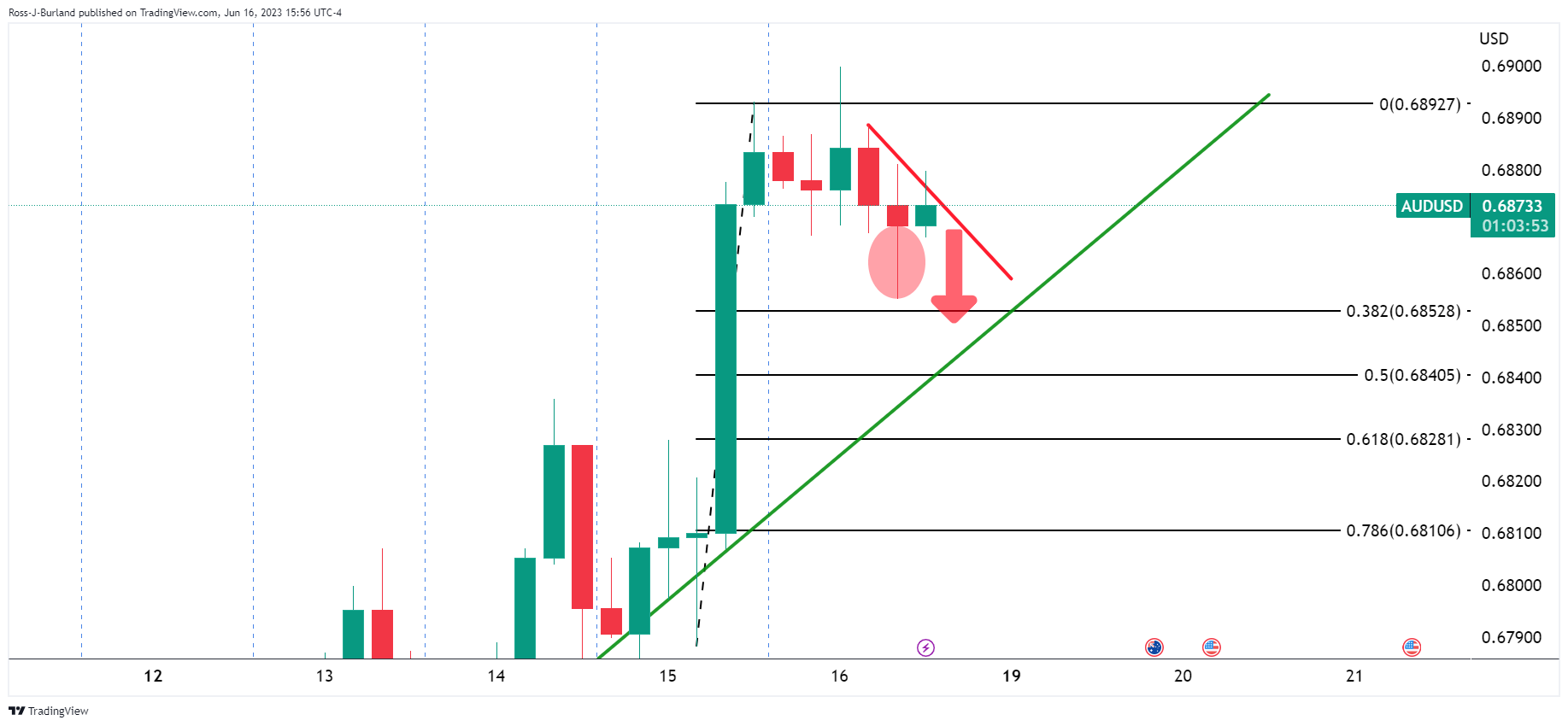

The Fibonacci scale is also a focus in this regard with the 61.8% eyed in confluence with key support on the 4-hour chart:

AUD/USD H4 chart

That wick is vulnerable to be filled to test the 38.2% Fibo thereafter.